Financial Statements Analysis of Commonwealth Bank and ANZ Bank

QUESTION: The Task

Select two companies in the same industry listed on the Australian Stock Market. Your analysis will be based on the latest three years’ annual reports which include the financial statements (Balance sheet, Income statement, and Statement of cash flows) and explanatory notes of your selected companies.

a.) You will need to collect data for the latest three years for the selected companies from the financial statements and other relevant information and conduct.

b.) Horizontal analysis of the Income Statement and Cash Flow Statement.

c.) Vertical analysis of the Income Statement and Balance Sheet.

d.) Ratio analysis (using two ratios for each of the five ratio categories.

e.) Your analysis should include relevant data to help a prospective investor decide in which of the two companies to invest all his lifetime savings. An in-depth evaluation of the company’s overall outlook for the future should be included.

Analysis of Financial Statements of Commonwealth Bank and ANZ Bank

Introduction

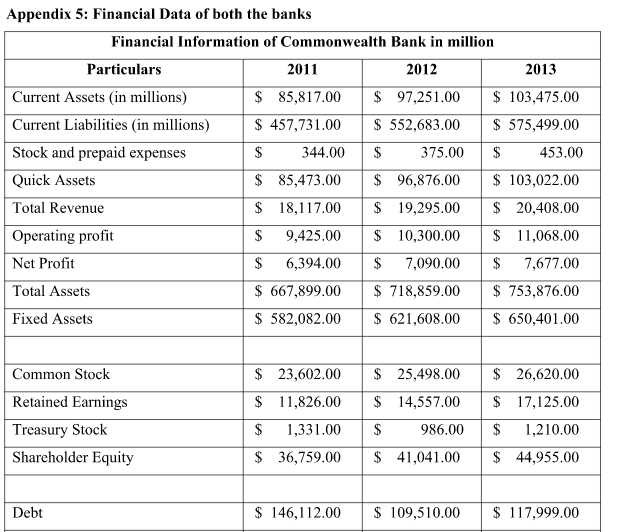

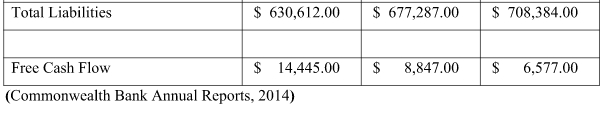

Analysis of financial statements is necessary to know the financial performance of the company. It helps investors to review the development of the company and on this basis, they make their decisions. In this report analysis of Commonwealth Bank and ANZ Bank has been conducted for the period of 2011 to 2013. Both these banks are based in Australia and are well known for their performance. Financial analysis of both these banks has been done on the basis of the relevant financial ratios to evaluate Commonwealth Bank and ANZ Bank position with respect to liquidity, solvency, profitability, Efficiency, and cash flow.

Brief introduction of Commonwealth Bank and ANZ Bank

Commonwealth Bank of Australia:- Commonwealth Bank of Australia is a bank of Australia that is known for providing various banking and financial products and services to retail, business, and institutional clients in various countries. The bank provides banking products and services to different countries like Australia, New Zealand, Asia Pacific, and the United Kingdom. Different type of banking products and services provided by the bank includes transaction accounts, savings account, term deposits, credit cards, personal and home loans financial planning services; superannuation products, products for youth and students, home, car, life, loan and credit card protection, income protection, and insurance products; and international and online banking services. The company is also known for providing business banking products, such as business accounts and credit cards; merchant services; business loans, overdrafts to its customers. In addition to this, the company also provides products and services in order to assist the corporate and institutional clients in managing the cash flow and liquidity.

Australia & New Zealand Banking Group Limited:- Australia & New Zealand Banking Group Limited is known to provide different banking and financial products to its personal customers. Presently the bank had 1,273 branches and is known to provide the best class of financial products and services to its customers. The company is involved in the credit analysis, structuring, execution, and ongoing monitoring of customers. The Banking Group Limited was founded in 1835 and is based in Melbourne, Australia. The customers of the bank are respectively retail, small business, corporate, and institutional customers in Australia, New Zealand, the Asia Pacific region, the Middle East, Europe, and the United States. Moreover, the company also offers motor vehicle and equipment finance, and investment products, regional business banking services to personal customers. Further, the company provides working capital solutions comprising deposit products, cash transaction banking management, trade finance, international payments, and clearing services; and risk management services to its customers.

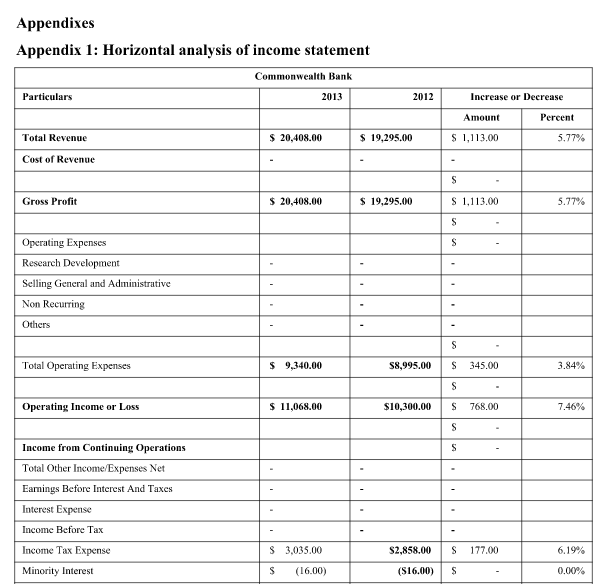

Horizontal Analysis of Income Statement

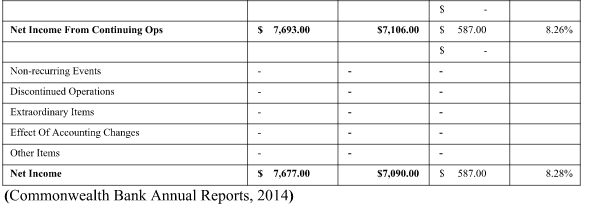

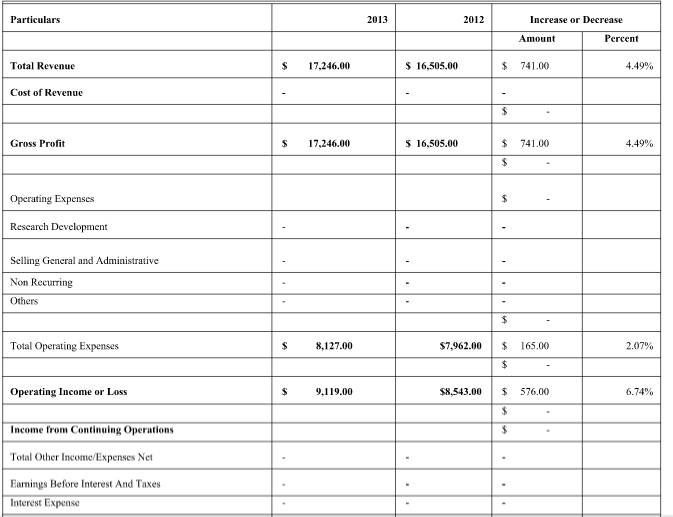

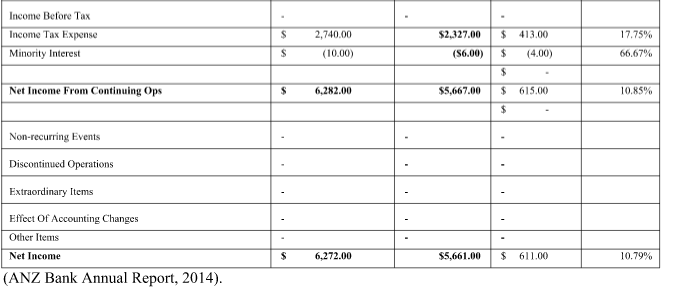

On evaluating the income statement using the horizontal analysis method it can be concluded that the profitability position of ANZ Bank is better as compare to Commonwealth Bank. It can be said by looking at figures for the increase in net profit of both the banks in the year 2013 as compared to the year 2012 (Fridson and Alvarez, 2011). There is an increase in net revenue by 5.77 % in the Commonwealth Bank and 4.49% in ANZ Bank. On the other hand, the net profit of ANZ Bank has been increased by 10.79 % as compared to an increase of 8.28 % in Commonwealth Bank. This indicates the better financial position of ANZ Bank as compare to Commonwealth Bank. Gross profit remains the same as the net revenue as there was not any cost of goods sold. On comparing the operating profit of both the banks it can be said that Commonwealth Bank has a higher net operating profit as compare to ANZ Bank. It indicates a better operating position of Commonwealth Bank as compare to ANZ Bank (Refer Appendix 1).

Cash flow statement

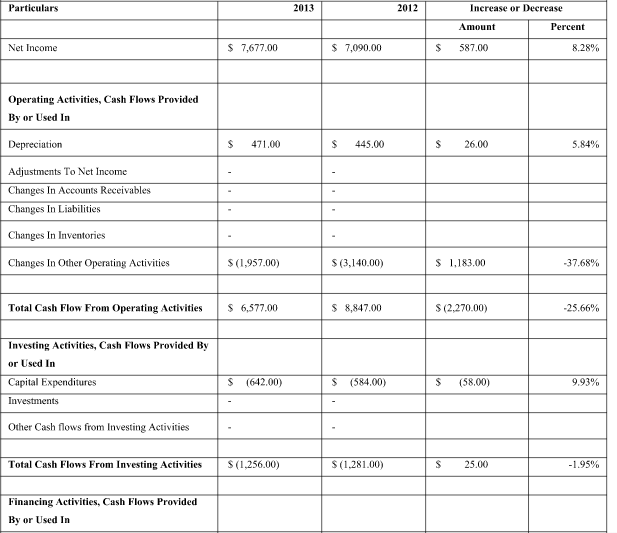

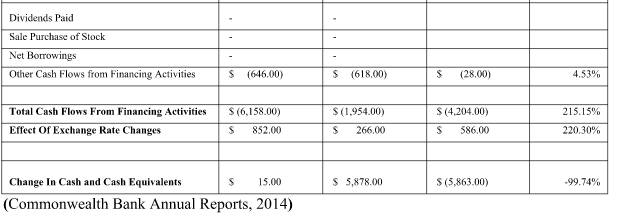

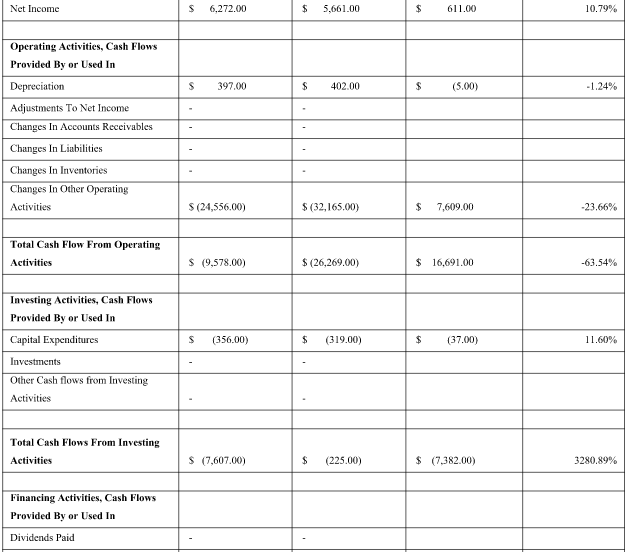

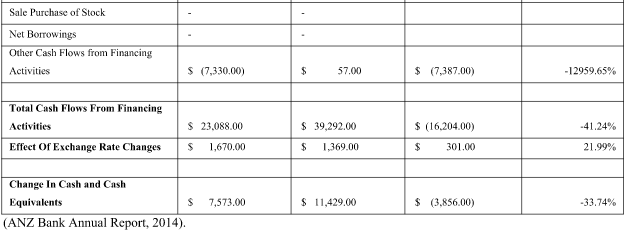

Horizontal analysis of the cash flow statement shows the percentage change in various activities in respect of the current year on comparing it with the previous year. Horizontal analysis of financial statements is very necessary to know the amount of change achieved by companies in current as compared to the previous year (Drake & Fabozzi, 2012). On the basis of this change performance of the company can be measured easily. On analyzing the cash flow statement of both the banks using horizontal analysis it can be said that ANZ Bank has a better cash position as compare to Commonwealth Bank. On looking at the change in cash and cash equivalent it is clear that ANZ Bank has suffered less negative change as compare to Commonwealth Bank. However operating activity shows the better position of Commonwealth Bank as compare to ANZ Bank (Refer Appendix 2).

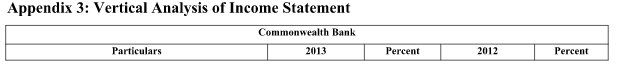

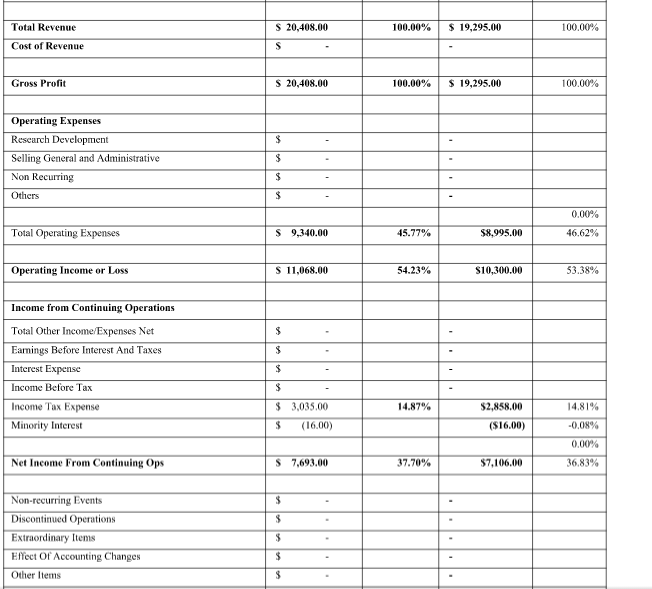

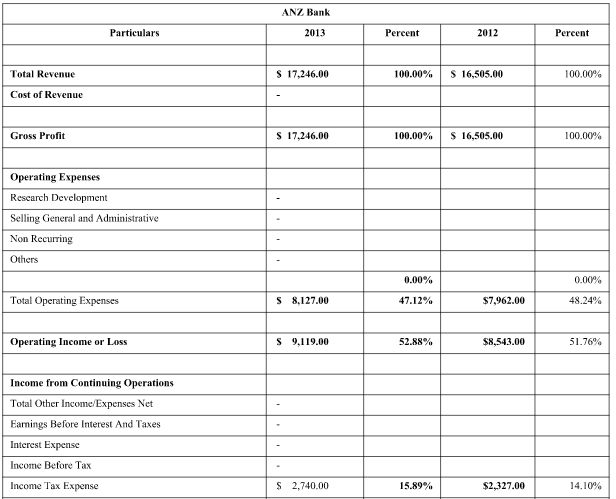

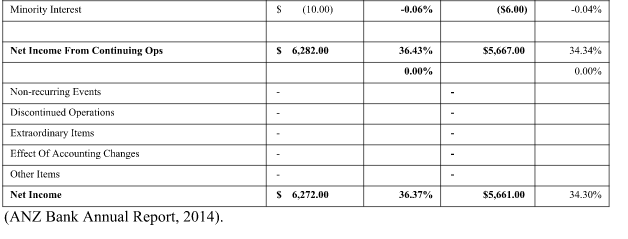

Vertical Analysis of Income Statement

Vertical analysis of the financial statements shows each item as the percentage of the base figure (Fridson and Alvarez, 2011). In the case of vertical analysis of income statement sales figure is used as a base and other items are calculated as the percentage of sales. Vertical analysis of income statements is used for inter-company comparison of companies having the same size. On comparing the income statements of Commonwealth Bank with ANZ Bank using a vertical analysis method it can be concluded that the percentage of net income of Commonwealth Bank was better as compare to ANZ Bank. It can also be noticed that percentage of net operating income to sales of Commonwealth Bank was better as compare to ANZ Bank (Refer Appendix 3).

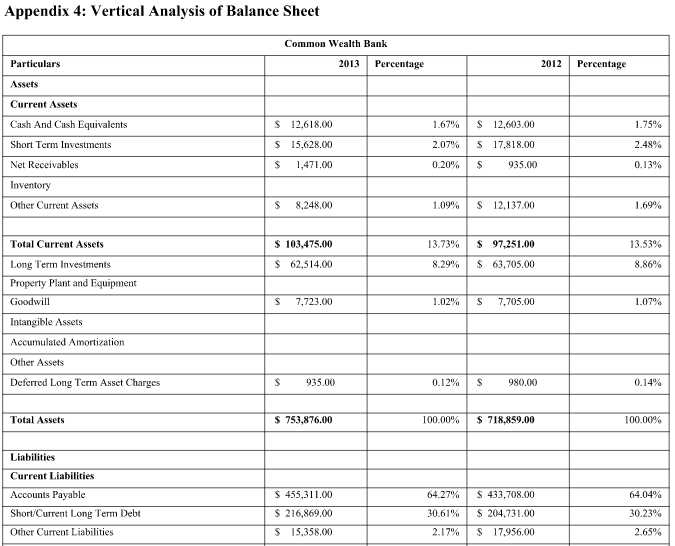

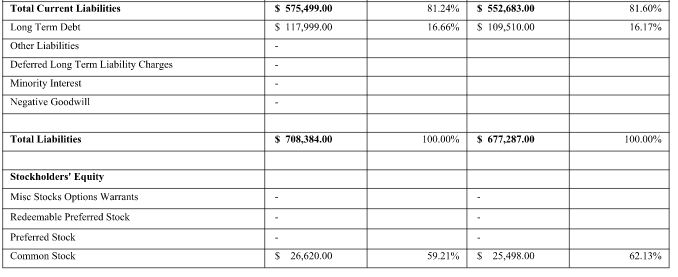

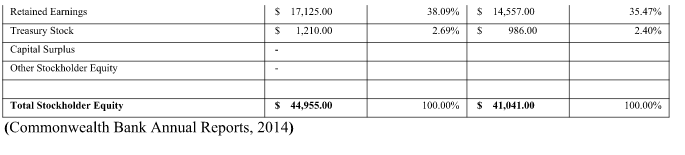

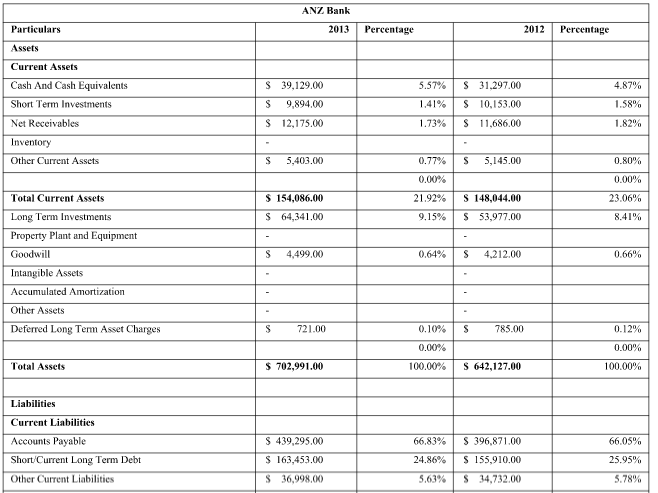

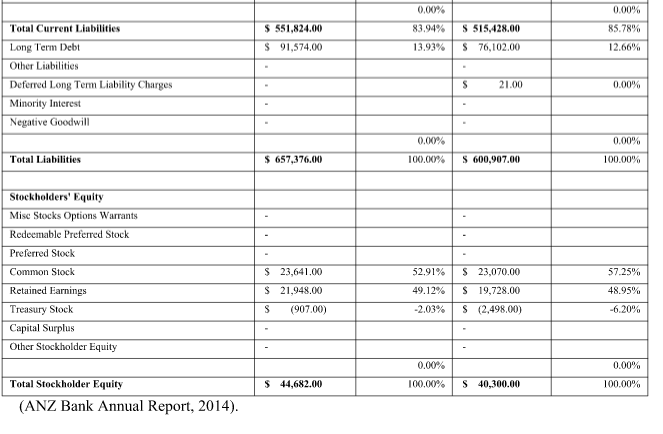

Vertical Analysis of Balance Sheet

Vertical analysis of the Balance sheet is referred to as the analysis of each item as the percentage of corresponding base figures like total assets, total liabilities, and total shareholder equity. In vertical analysis, all the individual assets are shown as the percentage of total assets and all individual liabilities are shown as a percentage of total liabilities. This analysis helps to compare the two companies on the basis of assets and liabilities maintained by both of them. On comparing the balance sheet of both the Banks using the vertical analysis method it can be concluded that the liquidity, as well as the debt position of ANZ Bank, is far better than Commonwealth Bank.

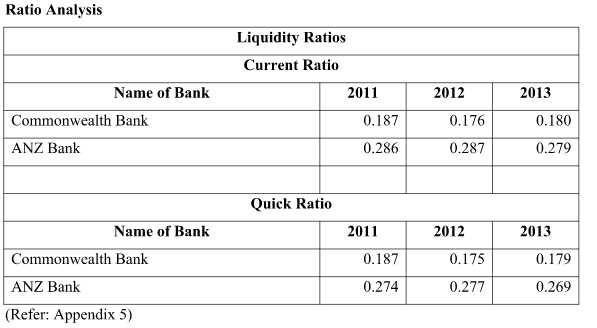

Liquidity ratios are used to calculate the ability of the company to pay its short-term liabilities and these ratios are often used by the investors to determine the liquidity position of the company in the near future. The current ratio is the first liquidity ratio that measures the short-term liability position of the company (Walton, 2000). This ratio provides the liquidity position of the company as it measures current assets upon current liability. On analyzing the current ratio of both the banks it can be concluded that the liquidity position of ANZ Bank is better than the position of Commonwealth Bank. The quick ratio is another form of liquidity ratio and it tells the liquidity position more clearly as compared to the current ratio. This ratio does not include inventory and prepaid expenses while calculating the quick assets as these assets take time to be converted into cash. On interpreting the quick ratio for both the banks it can be said that ANZ maintains more quick assets as compared to Commonwealth Bank.

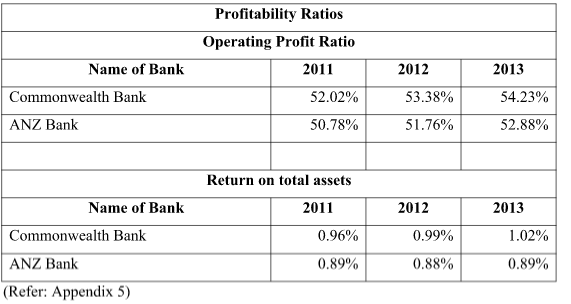

Profitability ratios show the profitability position of the company during the given period. Investors use these ratios to know the profit earned by the company on their revenue, total assets, and total investment made by the company (Walton, 2000). Operating profit ratios show the percentage of operating profit earned by the company on their sales. On analyzing the operating profit ratio of both banks for the last three years it can be revealed that the profitability position of Commonwealth Bank is better than the position of ANZ bank. Return on total assets tells the amount of net income earned on the total assets used by the company during the year. Commonwealth Bank has earned more return on the total assets as compared to ANZ Bank. It can be concluded that the profitability position of Commonwealth Bank is good as compare to ANZ Bank.

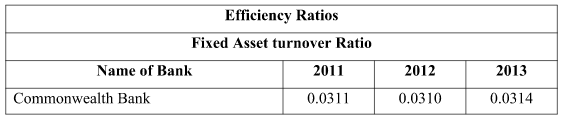

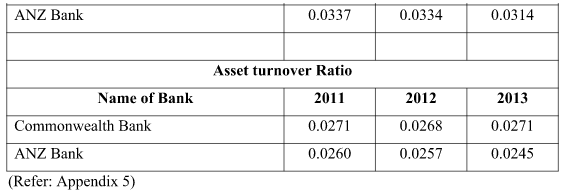

The fixed assets turnover ratio shows the amount of net revenue achieved by the company on its total assets. On comparing the amount of net revenue earned on the fixed by both the banks it can be said that there is no major difference in the earning capability of both the banks.

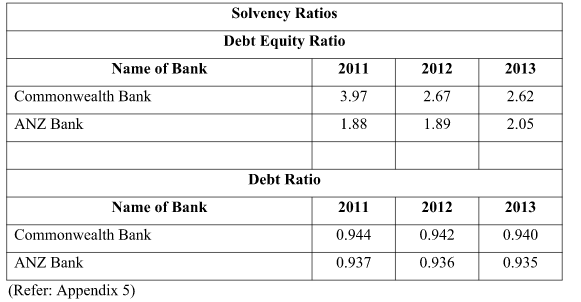

The debt-equity ratio is the amount of debt as against the amount of equity. It measures the level of debt used by the company to finance different activities in the company (Drake & Fabozzi, 2012). On evaluating the debt-equity ratio of both the companies it can be said that Commonwealth Bank is more dependent upon the debt to finance its business.

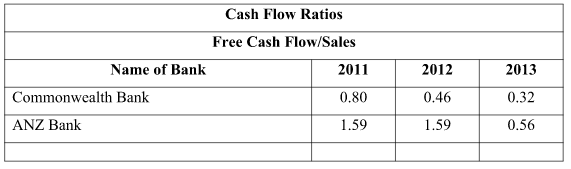

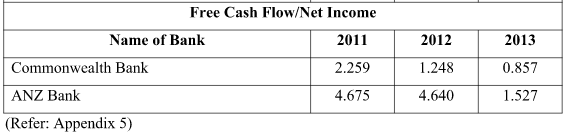

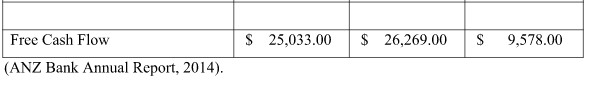

Cash flow ratios are used to calculate the amount of cash kept by the company to finance its day to business (Drake & Fabozzi, 2012). The free cash flow to sales ratio calculates the amount of free cash maintains by the company as against the sales. On evaluating it was found that ANZ Bank maintains more cash as compare to Commonwealth Bank.

Interpretation/Recommendation based on analysis of results

On the basis of the above financial analysis and other major factors, it is advised to the investors that they must invest their future investment funds in ANZ bank despite Commonwealth bank. This can be said because the liquidity position of Commonwealth bank was not sound and this bank has taken a great amount of outside loan against its available assets. It is clearly seen from the figures of the current ratio that Commonwealth Bank does not maintain current assets of 0.180 on the total current liabilities, which indicates that the bank can face a shortage of funds to finance its day-to-day activities.

The quick ratio, another indicator of short-term liquidity position, also shows a similar position that the current ratio has depicted. On comparing the current and quick ratio of bath the banks it can be said that ANZ maintains more current assets as compared to Commonwealth Banks. This indicates that ANZ Bank finances its major short-term requirements from the current assets as and when to compare with Commonwealth Bank. A few days back it was seen that the CEO of Commonwealth Bank has felt guilty for the multi-million dollar financial planning scandal (Janda, 2014). This financial planning of Commonwealth Bank has put investor’s money in highly risky investments without using any hedging techniques or financial measures. Due to this, major investors of Commonwealth Bank have suffered from huge losses as investments made by this bank ended up with a loss of no return. All this has been done without the permission of investors that clearly depicts how irresponsible the bank is.

On analyzing the profitability position of both the banks it can be said that both the banks earn the same level of profit in all the last three years. Operating profit ratios show that the Commonwealth Bank and ANZ Bank have earned an average operating profit margin of 50% to 54% in the years 2011 to 2013. The return of total assets of both the Banks is below one percent that indicates that banks maintain a high level of assets to earn such a small profit. This indicates that the profitability position of both of these banks was not sufficient to pay high returns to the investors. However, it can be said that ANZ Bank maintains a good level of return to investors despite low returns. Therefore, it is advised to the investors to invest in ANZ Bank to receive a high amount of return on their investment.

On analyzing the solvency position of the banks it can be said that Commonwealth Bank uses more debt finance as compare to ANZ Bank. In the Year 2013 debt-equity ratio of Commonwealth Bank was 2.62 as compared to the ratio of 2.05 of ANZ Bank. It is highly advised to investors must invest in ANZ Bank to safeguard their funds against the debt risk.

Cash flow ratios indicate that ANZ Bank maintains more free flow cash as compare to Commonwealth Bank. The ratio of free cash flow to sales of ANZ Bank was 1.59 as compared to 0.80 Commonwealth Bank in the year 2011. In the Year 2013 it has been changed to 0.56 for ANZ Bank and 0.32 for Commonwealth. All these ratios indicate that investors must invest in ANZ Bank for the maximum amount of return on their invested funds.

On the basis of the above analysis as well interpretation of ratios it is highly recommended to investors to invest only in ANZ Bank in future years in order to receive the high returns with no risk or very little risk.

Critical evaluation of the limitations of financial statement analysis

Financial statement analysis is essential for obtaining relevant information in order to make important decisions for formulating corporate plans and policies. However, the analysis of financial statements had several limitations which may mislead the management of the company in the decision making process (Bull, 2007). Thus, the financial statements of a company need to be prepared with extreme accuracy in order to provide the right information to the users. Ratio analysis plays an important role in the financial statement analysis of an organization. Analyzing the position of an organization through the help of financial ratios is an important part of the analysis of the financial statements of the company but it contains some limitations. Ratio analysis generally incorporates all the useful information in the financial statements but does not include some of the important factors that play a major role in interpreting the financial position of the company.

Ratio analysis is a significant tool of the company through which a firm is able to analyze its performance and predicts the future growth and profitability of the company. However, they are not the real representatives of the financial position of the company as through the help of financial ratio analysis the company’s position can be reflected only for a particular time period. Thus, it is often said that financial ratios are not a perfect tool to represent the exact financial position of the company for any financial year. Ratio analysis is based on the financial statements published by the company and they depict the position of the company only for a given point of time. Therefore, it is advised to perform the ratio analysis of the company at several points of time in a year in order to examine the current position of the company.

References

ANZ Bank Annual Report. (2014). Retrieved July 8, 2014, from https://www.shareholder.anz.com/pages/annual-report

Bull, R. (2007). Financial Ratios: How to use financial ratios to maximize value and success for your business. Elsevier.

Commonwealth Bank Annual Reports. (2014). Retrieved July 8, 2014, from https://www.commbank.com.au/about-us/shareholders/financial-information/annual-reports.html

Drake, P. P. & Fabozzi, F. J. (2012). Analysis of Financial Statements. John Wiley & Sons.

Fridson, M. S. & Alvarez, F. (2011). Financial Statement Analysis: A Practitioner’s Guide. John Wiley & Sons.

Janda, M. (2014). Commonwealth Bank boss Ian Narev says sorry for multi-million-dollar financial planning scandal. Retrieved July 8, 2014, from https://www.abc.net.au/news/2014-07-03/commonwealth-bank-responds-to-financial-planning-inquiry/5568504

Walton, P. (2000). Financial Statement Analysis: An International Perspective. Cengage Learning EMEA.

Hire Professional Australian Assignment Writer for Financial Statements Analysis of Commonwealth Bank and ANZ Bank Assignment

If you are looking for assignment help in Financial Statements Analysis of Commonwealth Bank and ANZ Bank in Australia, we at Australia Assignment Help can make it easy to get the best grades. We provide affordable assignment writing services because of our experienced writers who have been in this industry for many years and know how to tackle any type of assignment help or essay writing help that is given by your professor.

We have a team of writers from all over the world with expertise in different areas. All our writers go through a process where we verify their skills and choose them based on the subject they are good at. The best part is that you get to work with different writers, which gives you a variety of options when it comes to writing your paper.