MGMT20085: Operational Analysis and Effectiveness: Mortgage Refinancing at Vintage Building Society Assessment Answers

Case Study: Mortgage Refinancing at Vintage Building Society

Assessment Task 2: Analytical report

Executive Summary

The present report presents an evaluation and examination of the current refinancing process used by the Vintage building concept through the integration of service blueprint and service profit chain concept. In this relation, the report analyses the current refinancing process, examine the problems in the refinancing process of the banks according to operation management perspective and develop a new refinancing process for the bank according to the implementation of service blueprint and service profit chain concept.

The report will prove to be extremely beneficial for the Chief Executive Officer of the Bank for analyzing the loopholes in the refinancing process of the bank so that the loopholes can be easily identified and mitigated.

Buy high-quality essays & assignment writing as per particular university, high school or college for Australian student

Introduction

The present case study describes the challenges faced by the Vintage Building Society in the current refinancing process for home loans. Vintage Building Society was established in the 1950s and is completely owned by its members and is limited to do business with its own members only. Thus, society is a conservative financial institution and has recorded very slow growth throughout its history.

However, refinancing of home loans is one of the major areas of the Vintage Building Society that is gaining increasing importance among the customers. Potential customers of the Society in search of more economical loans are increasingly turning towards more economical loans and thus the applications of refinancing the home loans were received by the society in large numbers (Johnston, 1997).

Thus, in order to meet the needs and demands of customers, the Vintage Building Society developed a new loan approval process. However, the new loan approval process has some inefficiencies and inconsistencies that lead the company to think about the current problems in the refinancing process for eliminating them.

In this context, the present report presents a critical evaluation of the inefficiencies in the current refinancing process of the company and also describe from an operations management perspective, the measures to be adopted by the Chief Executive Officer of the Bank for redesigning the process and constructing a new service blueprint for the refinancing process (Roth and Menor, 2003).

Critical Evaluation Of The Refinancing Process

A.) Analysing the current refinancing process of the company

The current refinancing process of the company incorporates five states i.e. loan application, loan processing, loan closing, new account establishment, and at last loan payment setup. Each stage of the new refinancing process is dealt with a specific loan agent and the applications are processed by the loan processors and successful applications are passed by the loan closing specialists. The first step is applying for the loan by completing a loan application through the help of a loan officer.

The next step is the loan processing stage which incorporates verification of loans from other financial institutions, valuation of the property, and employment verification. The whole process is completed under the guidance of a loan processing officer (Roth and Menor, 2003). After the completion of this step, the loan closing officer sends the customer a letter describing the terms, conditions, and costs of the loan.

The loan closing officer calculates the final loan amount for the finalization of the loan. In the next step, a loan servicing specialist establishes a new account for the customer. In the last and the final step of the process i.e. loan-payment setup, the loan-payment specialist takes care of issuing payment books or setting up the automatic withdrawal of mortgage fees and calculating the exact monthly payments (Johnston, 1997).

Thus, the current refinancing process adopted by the Vintage Building Society for providing easy and economical loans to prospective customers. However, the company is experiencing some difficulties in this process and the customers are unsatisfied with the current refinancing process of the company (Roberts and Amit, 2003).

In this context, the service blueprint concept will prove to be a useful and effective tool for the company to examine the inefficiencies of its current refinancing process. A service blueprint is an operational planning tool that provides guidance for the company to plan the strategies for providing a specific service to the customers (Roth and Menor, 2003).

It specifies the physical evidence, staff actions, support systems, and infrastructure needed to deliver the service to the customer. In providing loans to the customer, the service blueprint concept helps to detail the procedure of providing loans, the kind of maintenance and support activities needed, the process of providing relevant information to the users, etc.

Service blueprinting involves the description of all the activities that are needed for designing and managing services. This includes the description of schedule plans, project plans, design plans for implementing new services in an organization (Roth and Menor, 2003).

The service blueprinting concept helps to develop new innovative services as well as improve existing services. It helps to visualize the service deigned in the early stages so that any weakness in the service development process can be easily identified and eliminated (Mahadevan, 2009). Thus, it becomes relatively easy to identify failure points and discover new ideas for innovation.

The service developed can be easily modified as per the requirements of the customer in its development phase only through the use of the service blueprinting concept. The technique makes it easier for the identification of cost-saving potential and provides an excellent base for improving the existing services of an organization (Mahadevan, 2009).

Services are rather difficult to visualize in their development phase due to their intangible nature. Thus, it is extremely difficult to overview the service process and thus modifies the service development process in accordance with the changing needs of the customer (Johnston, 2004).

The service blueprinting tool seems to be an effective tool for modifying the service development process to meet the needs and requirements of the customers that us not possible to do with help of prototypes. The concept of service blueprinting differs from other methods of process analysis as it is specifically customer-focused (Roberts and Amit, 2003).

Service blueprinting is an operational tool that describes the nature and the characteristics of the service interaction in detail in order to implement and maintain it in the organizations. The concept helps to develop an overall flowchart of the service process in order to demonstrate the relation of each job or department function to the service as a whole.

Thus, it is a visual presentation of customer experience with the use of a particular service. In addition to this, it also helps to identify the future experience of customers in relation to a service concept (Johnston, 2004).

Buy high-quality essays & assignment writing as per particular university, high school or college for Australian student

Thus, the application of the service blueprint concept to the current refinancing process of Vintage Building Society, it can be analyzed that the process has certain inconsistencies and inefficiencies that are causing the problems in the refinancing process of the company (Baum, 1990). The service blueprint concept emphasizes developing customer-focused service while the current refinancing process of the company does not take into account the needs and expectations of the customer.

Service blueprinting operational tools are typically client-focused and the present refinancing process used by the company is based on standard procedures and lacks customization (Johnston, 1997).

The concept aims to improve the flexibility of the service provided by the organizations and the current process used by the Vintage Building Society is inflexible to be modified as per the needs and requirements of the customer. Service blueprinting considers client requirements in association with the firm’s internal requirements.

On the other hand, the refinancing process of the society emphasizes only meeting the firm requirements and thus the process is inadequate in gaining customer satisfaction (Baum, 1990).

Vintage Building Society might have designed the refinancing process for home loans in order to incorporate standardization in their refinancing process. Refinancing of home loans is a major area of society that is rapidly booming thus the bank has only designed the process in accordance with the internal firm requirements and completely ignored customer requirements (Boughnim and Yannou, 2005).

The bank has designed the process so that the process does not have any weakness and is safe ad secure or the bank to be implemented and also to mitigate the risk associated with providing loans to the customers (Menor, 2006).

The banks through the process ensure smooth functioning of its refinancing loan scheme and ensure the successful collection of mortgage payments from the customers.

Also, the banks ensure through the process that the loans are only available to the customers that have high credibility to pay mortgage payments to the banks in order to minimize the risk of default (Boughnim and Yannou, 2005).

B.) Operations management perspective on the refinancing process of the bank

Operation management is concerned with managing the processes of an organization from the development of services to delivering the final service to the customers. The effective and efficient management of the operational function is essential for the success of an organization and for developing a competitive advantage over the competitors.

The services provided by retail banks aim to enhance customer satisfaction by offering all the products and services of the banks to the customers at the same place (Nagar and Rajan, 2005). Vintage Building Society aims to develop a refinancing process of home loans that is able to meet all the standard requirements so that there are no loopholes in any stage of the process. However, the firm is facing problems with the current refinancing process as it is not able to satisfy the needs of the customers (Kroner, 2010).

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

The current process may have caused many problems for the customers. The refinancing process developed by the bank is quite complex and difficult for the customers to understand. The process incorporates many stages and the steps involved in each stage are relatively lengthy and also difficult to be understood by the customers. In each and every stage, there are a lot of requirements that are to be completed by the customers and this consumes a large amount of time for the customers.

The process at each stage is guided by a specialist in that particular area for managing it properly (Johnston, 1997). This is a good strategy of the bank but this also involves an increase in the complexity of the process and also the customers may refrain from visiting so many specialists at each stage as this may seem to be time-consuming to them. The lack of flexibility is also one of the major problems associated with the current refinancing process of the banks.

The refinancing process is very rigid and does not take into account the expectations of the customer and is carried out in a well-defined manner. The customers may not feel satisfied as their needs and expectations are not considered by the current refinancing procedure adopted by the bank (Hutt and Speh, 2012).

The increasing complexity of the process also develops the problem of longer processing time in the loan approval process as compared to other banks. Another problem that arises in the current refinancing process of the banks was higher mortgage payments as compared to other banks (Maritz and Nieman, 2009).

The increasing number of procedures to be taken for completing the process has also enhanced the ambiguousness as customers are getting calls from the banks regarding the mortgage payments that are automatically taken by the banks from the cheque account.

Also, the procedure implemented by the bank for the verification of the credit report is very long that it takes much time for the customers and thus leads to the increasing number of unsatisfied customers of the bank (Carter, Shaw, Lam and Wilson, 2007).

Thus, the new process is ineffective in providing customer satisfaction and thus banks require proper measures to be adopted for overcoming all the inefficiencies and inconsistencies of the refinancing process of the banks.

C.) Implementation of service-profit chain concept and service blueprinting for redesigning the process

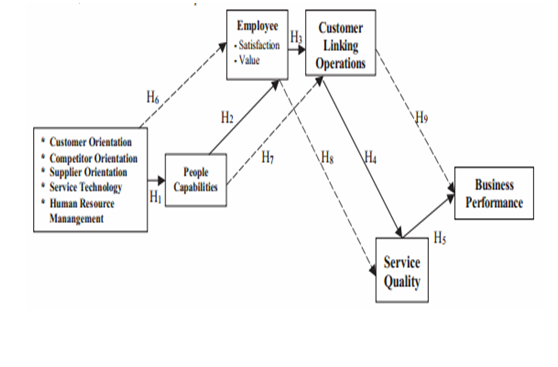

The service profit chain concept helps to establish a relationship between profitability, customer loyalty, employee satisfaction, loyalty, and productivity. There are various links in the chain such as profit and growth are stimulated by customer loyalty. Loyalty is obtained through customer satisfaction and satisfaction is influenced by the type of services provided by a firm to its customers (Sander and Kleimeier, 2004).

The increased satisfaction of the customers from organization services helps in increasing the productivity of a firm. Thus, the service profit chain concept helps the firms to develop a relationship among its various components so that all the components affecting customer service can be integrated to develop strong and effective relations with customers (Kroner, 2010).

On the other hand, the service blueprinting concept aims to provide effective services to the customers through effectively meeting their needs and demands. Service profit chain concept can be described through the use of the following steps:

a.) Customer loyalty drives profitability and growth:- According to this, an organization must emphasize achieving customer loyalty as customer loyalty drives profitability and growth (Hutt and Speh, 2012). Thus, the Vintage Building Society should focus on developing the strategies that aim to enhance the satisfaction of the customers for improving their profits and sales that is essential for their future growth and development (Carter, Shaw, Lam and Wilson, 2007).

b.) Customer satisfaction drives customer loyalty:- Customer satisfaction is essential for gaining the loyalty of customers and increasing the retention rates of customers. The current refinancing process of the company is extremely difficult to be understood by the customers who are having a negative impact on enhancing customer loyalty towards the bank.

c.) Employee loyalty drives productivity:- Employee satisfaction is also essential for increasing the productivity of an organization as employees play an intrinsic part in improving the output of an organization.

d.) Employee satisfaction drives loyalty:- The increasing satisfaction of employees from an organization is responsible for increasing the loyalty of employees which consequently leads to increased growth and development of an organization.

The current refinancing process of the company can be redesigned through the use of service blueprint and service profit chain concept as follows:

1. Identifying the needs and requirements of the target customers

The first step before implementing the refinancing process should be to appropriately determine the needs and requirements of the target groups. Target groups should be identified clearly to determine their needs and requirements according to their age, gender, profession, lifestyle, etc. This is a part of the requirement analysis phase that is done before developing the service profit chain and service blueprint concept for redesigning the process (Guffey, 2007).

2. Redesigning the refinancing process from the client’s point of view

The next step is redesigning the refinancing process of the Vintage Building Society in accordance with the needs and demands o the customers identified in the previous step. This includes a reduction in the complexity of the process, adopting greater transparency and reliability in the process, reducing loan processing time, and eliminates any confusion that arises within the process (Sander and Kleimeier, 2004).

This is done by modeling the service as perceived by the client. The company should develop an optimal service that should focus only on one specific target group. The complexity of the process can be decreased by implementing and adopting a simple linear process that is composed of individual sequential steps (Johnston, 1997). According to the service blueprint concept, there are three types of interaction lines between the client and customer.

First is the visibility line that distinguishes service activities that can be seen from the client from the activities that are hidden from the clients. Next is the internal interaction line that separates activities that are of prime importance to the client from the support activities. The last is a control line that separates the preparation activities from the general management activities (Carter, Shaw, Lam and Wilson, 2007).

Thus, in this step, the process steps that are performed by the clients are placed above the interaction line. Process steps that are in direct contact with the client and firm are located between the interaction line and visibility line. This helps in building the service process that can effectively meet the needs and demands of the customer (Homburg, Wieseke, and Hoyer, 2009).

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

3. Resource and time allocation

The next step is allocating proper resources and time for designing each step of the refinancing process. This is necessary for reducing the processing time that is usually taken at each stage of the process which leads to increasing dissatisfaction in the customers. It is necessary to determine the process time frame to eliminate the inefficiency of consuming more time in the current refinancing process of the company. Appropriate process durations are defined in advance for each activity for increasing the effectiveness of the current refinancing process.

4. Creating service blueprinting for existing service

Developing a service blueprint for the current refinancing process of the company will help to identify the recent weakness in the process and develop a proper framework in order to identify the loopholes identified in the current refinancing process of the company. Analyzing and examining the current status of the service process it is possible to identify current areas of improvement within the service sequence (Homburg, Wieseke and Hoyer, 2009). The potential points of improvement can be easily identified through the help of developing a service blueprint for existing services.

Thus, by implementing these steps the current refinancing process of the company can be easily modified and customized according to the needs and requirements of the customer. Thus, the implementation of the service profit chain and service blueprint concept will help to identify the gaps between the current and expected to refinance process of the Vintage Building Society.

Conclusion

Thus, from the overall discussion held in the report, it can be recommended to the Vintage Building Society to redesign its current refinancing process as per the needs and requirements of the customers to enhance customer satisfaction. The loan approval process of the company is time-consuming and has many inefficiencies and inconsistencies that are responsible for the increase in the number of unsatisfied customers from the recent refinancing process of the company. Service blueprint and service profit chain concept, in this context, can prove to be extremely useful for the bank to develop the refinancing process in accordance with the needs and requirements of the customer.

The service blueprint concept will prove to be a useful and effective tool for the company for examining the inefficiencies of its current refinancing process. Service blueprint concept helps to detail the procedure of providing loans, kind of maintenance and support activities needed, the process of providing relevant information to the users, etc. The service profit chain concept helps to establish a relationship between profitability, customer loyalty, employee satisfaction, loyalty, and productivity (Sander and Kleimeier, 2004).

The refinancing process of home loans is a booming sector for the company and thus the bank should place increased focus on developing effective strategies for attracting customers. Service blueprint concept helps to redesign the refinancing process of the Vintage building Society in the first phase, new ideas are found and their potential feasibility in the market is evaluated. In the second phase, concrete client and firm requirements for the service are collected.

In the next phase, service Design is tested and modifies as per the needs and requirements of the customer. The service must be tested; if the results are poor, the feedback loop is entered and the Service Design phase is repeated. Thus, the service blueprint concept and service profit chain concept both will prove to be extremely effective for the Vintage Building society to redesign its current refinancing process.

References

Baum, S. H. 1990. Making your service blueprint pay off. The journal of services marketing. 4(3), pp. 45-52.

Boughnim, N., and Yanou, B. 2005. Using blueprinting for developing product-service systems. International conference on engineering design 1 (13), pp. 1-16.

Carter, S., Shaw, E. Lam, W., and Wilson, F. 2007. Gender, Entrepreneurship, and Bank Lending, Mortgage Refinancing: The criteria and processes used by bank loan officers in assessing applications. Entrepreneurship Theory and practice pp. 427-444.

Guffey, M.E. 2007. Business Communication: Process and Product. Cengage Learning.

Homburg, C., Wieseke, J. and Hoyer, W.D. 2009. Social Identity and the Service–Profit Chain. Journal of Marketing 73, pp. 38-54.

Hutt, M., and Speh, T. 2012. Business Marketing Management: B2B. Cengage Learning.

Johnston, R. 1997. Identifying the critical determinants of service quality in retail banking: importance and effect. International Journal of Bank Marketing 15(4), pp. 111-116.

Johnston, R. 2004. Operations: From Factory to Service Management. International Journal of Service Industry Management 5 (1), pp. 49-63.

Kroner, N. 2010. A Blueprint for Better Banking Mortgage Refinancing. Harriman House Limited.

Mahadevan, B. 2009. Operation Management: Theory and Practice Mortgage Refinancing. Pearson Education.

Maritz, A., and Nieman, G. 2009. Implementation of service profit chain initiatives in a franchise system. [Online]. Available at: https://137.215.9.22/bitstream/handle/2263/10250/Maritz_Implementation(2008).pdf?sequence=1 [Accessed on: 25 September 2014].

Menor, L.J. 2006. Insights into service operations management: A research agenda Mortgage Refinancing. Production and operations management 12(2), pp.145-164.

Nagar, V. and Rajan, M.V. 2005. Measuring Customer Relationships: The Case of the Retail Banking Industry: Mortgage Refinancing. Management Science, 51(6), pp. 904-919.

Roberts, P.W., and Amit, R. 2003. The Dynamics of Innovative Activity and Competitive Advantage: The Case of Australian Retail Banking, 1981 to 1995. Organization Science, 14(2), pp. 107-122.

Roth, A.V., and Menor, L.J. 2003. Insights into service operations management: a research agenda. Production and operations management 12 (2), pp. 145-163.

Sander, H., and Kleimeier, S. 2004. Convergence in euro-zone retail banking? What interest rate pass-through tells us about monetary policy transmission, competition, and integration. Journal of International Money and Finance 23, pp. 461-492.