HA3042: Taxation Law Individual Assessment Answer

Taxation law is a subject which deals with the basic legislative concepts of taxation as well as it’s petitioning. The HA3042 taxation law emphasizes the various concepts of taxation which encompasses Goods and service tax, Fringe benefits tax, capital gain tax, etc.

These are the basic taxation terms that are covered in the HA3042 subject.

This is one of the important subjects which are taught to the management students in their graduation and post-graduation. But the student finds it difficult to understand how taxes are imposed in a country. Our experts are the taxation law professionals who offer a great assessment answer help to the students.

Finding an assessment answer for HA3042 Taxation law is not an easy task. Our experts have complete knowledge about this subject which makes it easy for them to assess any kind of taxation imposed on a country. Our experts understand the need of the university and accordingly, they offer good taxation accounting assignments to the management students.

HA3042 taxation law course outcome

Students who study the HA3042 Taxation Law course come to understand the tax imposed on the different goods and activities in the country. They also come to know about the percentage of tax implied on the income of an individual or group of individuals.

The experts also offer help to the students about the consequences of tax evasion. There are many codes of conduct that students feel difficult to understand. But these experts also offer great help to the students by offering them assessment answers on HA3042 Taxation Law.

Buy high-quality essays & assignment writing as per particular university, high school or college for Australian student

Questions and answers under HA3042 Tax law Assessment

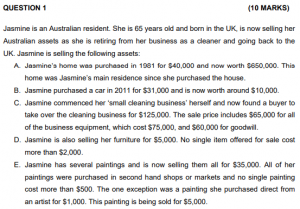

For example, a case symbolizes that Jasmine wants to sell all her assets as she is moving back to her hometown in the UK. This case deals with some questions which help her to sell her assets with a capital gain.

- How capital gain is calculated for a family home?

- selling a car would be beneficial or not?

- What amount of capital gain she can get from the sale of her business?

- Is furniture sale will make a capital loss or gain?

- She has a collection of paintings, so how capital can be calculated from the sale of the painting?

Answer1

According to the case study, Jasmin purchased a home during the year 1988. So according to our HA3042 taxation law experts, Jasmin could not avail capital gain by selling the property. Not only this she is also not entitled to any capital benefit from disposing or transferring the property.

Answer 2

Personal belongings or personal assets or movable assets. Therefore, you can not categorize under the assets. Taxation of such as comes under the Provision Act 1997. Another thing is that this asset has depreciation so it cannot give the benefit of capital gain.

Answer 3

Before selling, transferring for disposing of the business it is necessary to understand the nature of the business. Our taxation law experts say that any Asset which owners use for business purpose cannot be added into capital gain or losses because they have depreciation.

For example, if Jasmine is in the manufacturing business then the production machine must have depreciation which you need to write off against the capital gain and after analyzing its value you can calculate the business capital gain or loss .

Answer 4

capital gains from the selling of painting any precious things like coins, etc create difficulty for students in understanding that they are getting any capital gain or loss in such a situation. Our experts are always there to support the students and getting the correct answer. According to our taxation law experts painting is known to be a Capital Asset and the taxation impose on the selling of painting or anything related to it is taxable under the Capital Asset and capital gain and loss come out of it.

Answer 5

Furniture is a personal belonging that has its depreciation every year. This has separate law of taxation that comes under the provision of taxation in 1997. So it is not beneficial for Jasmine to sell their furniture as it will not help her to generate capital gain because the value of furniture is depreciating each year.

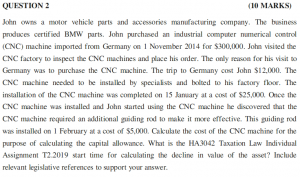

As per the above case of the HA3042 taxation law assessment, the students have to find the cost of legal elements for the CNC machines and it’s legal principles as well. Our experts have special knowledge about the taxation law so it is not difficult for them to find out the solution for this CNC machine and its principle of finding the element of cost.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

A handful of Qualities of HA3042 Taxation law individual assessment answer experts

Our team of law experts possessed much quality as they have professionals who have complete knowledge about taxation law. Some of the qualities are as follows :

- 24*7 availability– Australia assignment help experts are available all day and night to offer taxation Law help to the management students. They are available over an email so that the students can connect with them anytime.

- On-time submission– Our legal experts provide quality HA3042 taxation law assignment help. They help students in submitting assignments before deadlines.

- Quality of content– Our expert writers offer high-quality content to the students. This taxation and law are very critical things for which our professionals make research papers. This makes them offer good quality content to the management students.

- Plagiarism-free work– Our writers do not copy any content from the other sources. Our professionals provide HA3042 taxation law assessment answers based on facts, which they assess on their own.