Management Accounting Coursework Writings – University of Australia

Question 1: Total of 11 Marks

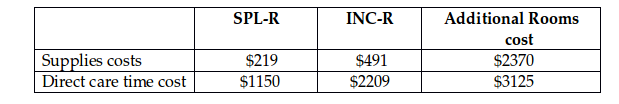

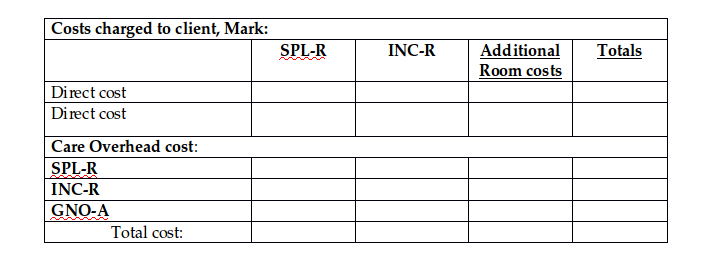

Gadgets Care resorts to Job-costing in costing and then billing its aged clients. During June 2018, the firm management budgeted 4125 Care Hours and 2160 Care Hours for the Speciality Room (SPL-R) and the Intensive Care room (INC-R), respectively. The care overhead costs budgeted by the management for each of the room types for June 2018 were $271 500 and $235 000, respectively. The management had budgeted care overhead costs of $990 000 and 16150 care hours, for June 2018, for the general Open Area (GNO-A) of the care facility. One aged client, Mark, spent ten hours and five hours, respectively in the SPL-R and INC-R rooms. Mark spent 100 additional hours at the facility in GNO-A. The care facility has also incurred the following costs on Mark:

The management at the care facility applies care overhead costs to clients on the basis of a budgeted overhead rate.

Stuck in Completing this Assignment and feeling stressed ? Take our Private Writing Services.

Required:

Work out the total cost the care facility incurred on Mark’s stay (Round off all calculations to the nearest unit/dollar), using the following template/format:

Question 2 Total 8 Marks

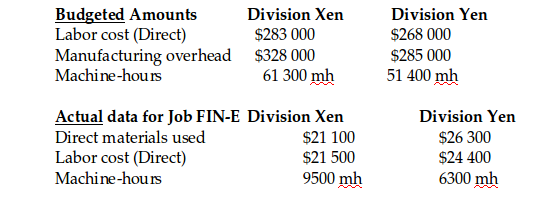

You are a management internee at the Gadgets Company. The company operates with two Divisions, Xen and Yen, and produces designer toy cars. For Division Xen, the management applies overhead costs on the basis of direct labor cost, and for Division Yen, it applies overhead costs on the basis of machine-hours. The company completed Job FIN-E in late 2017. The company’s books reveal the following additional information:

Required: Your supervisor has asked you to work out the following, showing all your calculations (round off to two decimal places):

-

The manufacturing overhead rate (budgeted) for Division Xen.

-

The manufacturing overhead rate (budgeted) for Division Yen.

-

The total overhead cost (budgeted) allocated to Job FIN-E.

-

The unit cost for job FIN-E if the Job required Gadgets to produce 1065 designer toy cars.

Get Solution of this Assessment. Hire Experts to solve this assignment for you Before Deadline.

Question 3 Total 4 Marks

Companies usually, in pursuit of refining their costing system, adopt Activity-Based Costing systems with an aim to arrive at accurate cost figures. Describe, in your own words, the prominent factors/reasons (any four) that contribute to these companies’ taking such initiatives. That is, what are the main factors that are causing these companies to consider refining their costing systems?

Question 4 Total 14 Marks

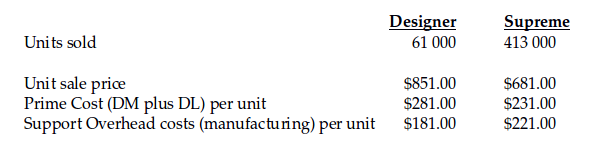

Gadgets Manufacturing manufactures two models of Dining Table and Chair Set: Designer and Supreme. All Support Overhead costs are allocated to both models on the basis of direct labor (DL) dollars/cost. For 2018, Gadgets’ books reveal the following pieces of information:

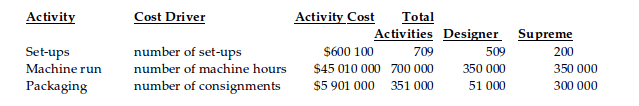

Gadgets recently automated part of the procedure for the Designer model with an aim to further improve the quality of the Designer line. The company management proposed that the company should evaluate whether the ABC system would be better for the company to implement. She thinks that ABC system would help the company make more informed decisions on product mix and strategy decisions. Gadgets books reveal the following Activity-Based information:

Required:

A. (2 marks – 1 marks each) Under the current costing procedures, how would you work out:

1. the per-unit manufacturing cost for each model of the Dining Table and Chair Set?

2. the profit per unit for each model of the Dining Table and Chair Set?

B. (1 marks) Under the current costing procedures, the Support Overhead costs per unit for the Designer model are less ($181 per unit) compared to those of the Supreme model ($221 per unit). What do you see as the most likely reason for the difference?

C. As part of the company’s evaluation of the ABC system implementation, work out: (11 marks: 3 marks for ‘1’, 6 marks for ‘2’, and 2 marks for ‘3’)

1. the cost-driver rate for each of the three activities, listed above.

2. The ABC system-based per unit overhead cost for each model of the product.

3. The ABC system-based per unit total cost for each model of the product.

Question 5 Total 10 Marks

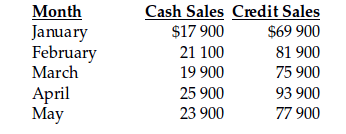

Gadgets Corporation’s 2019 forecasts reveal the following sales budget:

Based on past track record, Gadgets expects to collect 35% of all credit sales in the month of sale, 50% of all credit sales in the month following the sale, and 9% two months following the sale. Gadgets expect the remaining 6% to be uncollectible bad debts.

Are You Searching Answer of this Question? Request Australian Writers to Write a plagiarism Free Copy for You.

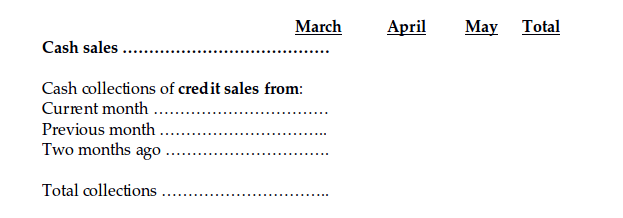

Required: Prepare a schedule showing cash collections (from both Cash and Credit sales) for March through May 2019 using the following format:

Get Help By Expert

Looking for fantastic managerial accounting assignment writing Australia services? Then go nowhere else and come to AustraliaAssignmentHelp.online and take our services right now. Our coursework writing help Australia services are for every students help and make them class topper.

Recent Solved Questions

- SITHKOP005: You will be observed coordinating cooking operations using 2 different food production processes: Coordinate cooking operations Assignment, VU, Australia

- HI6027: Barbara was a Regular Shopper at Egeeay Supermarket, Which was Part of a Large National Supermarket: Business and Corporate Law Assignment, HI, Australia

- You are to Select a Publicly Listed Dividend-Paying Company from the Australian Stock Exchange: Corporate Finance Research Paper, GU, Australia

- HA2011-Managerial Accounting Assessment Answer

- HI5015 Legal Aspects of International Trade and Enterprise

- You will be Assigned An Emerging Ethical AI Framework to Investigate: Information Technology Report, MU, Australia

- CHCCOM005: Demonstrated Effective Communication Skills In 3 Different Work Situations: Communicate And Work In Health Or Community Services Assignment, SBT, Australia

- What is Your Evaluation of Jenkins Proposed Approach to Changing: Stakeholder Value and Ethics Case Study, GU, Australia

- C6007: Identify two different approaches to time series analysis. In the space provided, identify and briefly describe the two approaches: Artificial Intelligence Assignment, Monash University, Australia

- What Is Life Skills Counseling In Which Areas Of A Client’s Life Do Life Skills: Life Counselling Assignment, VU, Australia