HI5001: Urban Consulting, a building consulting firm has just started its business The owner of the firm engaged you to prepare yearly financial statements: Accounting for Business Decisions Assignment, HI, Australia

| University | Holmes Institute |

| Subject | HI5001: Accounting For Business Decision |

Question 1

Urban Consulting, a building consulting firm has just started its business. The owner of the firm engaged you to prepare yearly financial statements for their first year ended 30 June 2020 on both the cash basis and the accrual basis. You have been provided with the following selected data for the year.

- During the year, cash payments of $174,900 were made for salaries and other expenses incurred during the period.

- Salaries owing to employees but not yet paid amount to $6,600.

- Insurance of $9,900 that will cover the next financial year was prepaid on 30 June.

- During the year, a total of $206,250 consulting fees was collected for services provided.

- There were $13,200 in receivables on 30 June 2020 for services performed on credit.

- On 20 June 2020, a client paid $4,950 in advance for services to be rendered during the next financial year.

Question 2

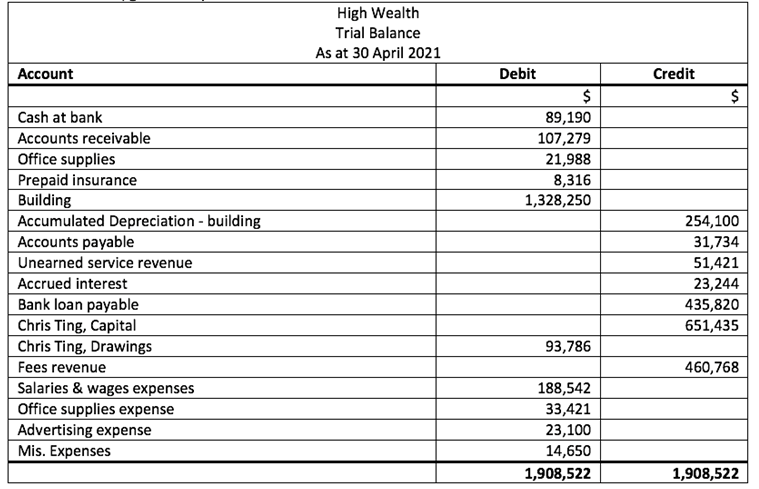

Chris Ting owns a financial planning advisory business operating under the name High Wealth. The firm prepares financial statements every month. The unadjusted trial balance of High Wealth as of 30 April 2021 is shown below (ignore GST).

- On 30 April, a physical count showed office supplies totaling $6,500 were still on hand.

- Insurance that covers 1 year was purchased on 1 April 2021.

- When the building was purchased, its useful life was estimated to be 25 years with a residual value of $2,000 at the end of its useful life. The estimation has not changed. The straight-line method is used.

- The amount of the unearned service revenue represents pre-collected fees from clients for services to be performed. 20% of the services have been performed in April.

- On 15th April, High Wealth signed an agreement to provide financial planning services to a client for a monthly fee of $1,200. It has been agreed that the fee is to be received on the 15th day of the following month. The service for the month of April was performed before 30 April. No entry was recorded when the agreement was signed.

- Interest for a 5-year bank loan is to be paid at the end of each financial year ending 30 June. Interest on bank loans is 8% per annum.

Are You Searching Answer of this Question? Request Australian Writers to Write a plagiarism Free Copy for You.

Get Help By Expert

Are you looking for urgent assignment writing in Australia? Then you are in right place. Australia Assignment Help has a team of efficient experts who have great capability to solve all types of tough problems related to HI5001: Accounting For Business Decision assignment within the deadline.

Recent Solved Questions

- BSB50420: Explain the process to establish and review profits and losses from financial statements: Diploma of Leadership and Management Assignment

- BSBITU212: When is It Necessary to use a Spreadsheet rather than a Word Processing Application: Create and Use Spreadsheets Assignment, DU, Australia

- Describe thoroughly the campaign using the terms and notions in integrated marketing communication: Marketing of Management Essay, UM, Australia

- ICTNWK424: While designing a network for one of ABC Inc’s branch offices, Edward realized that he couldn’t simply use the default: Install and operate small enterprise branch networks Assignment, ACA, Australia

- BSBITU313: Set Up Your Desk Ergonomically Before You Commence: Design And Produce Digital, DU, Australia

- BSBADM502: Develop an Agenda for a Formal Committee Meeting that Includes the Following Items in the Appropriate Order: Manage Meetings Assignment, VU, Australia

- Jack Jones is a 42 year old man who has had several psychiatric admissions, his first when he was 18 while he was in his first year at university: PATIENT CARE ESSAY, Australia

- Assessment comprises two continuous assessment tasks, aimed at advanced understanding of health psychology: Health Psychology Report, UU, Australia

- NURS3003: Discuss your understanding of the link between chronic health conditions, complex needs: Dynamics of Practice 3 – Hospital avoidance Case Study, Flinders University, Australia

- Jake Santiago (Jake) And Amy Peralta (Amy) Conduct A Business As Financial Planners: Equity & Law Assignment, BU, Australia