Middleton Expects to Buy a 9.5% Coupon, 15 years Bond Today When It is First Issued by Alex PLC: Accounting Assignment, CSU, Australia

| University | CSU |

| Subject | Accounting |

Question 1:

a. Middleton expects to buy a 9.5% coupon, 15 years bond today when it is first issued by Alex PLC. If interest rates suddenly rise to 12.5%, what happens to the value of Middleton’s bond? Why? (Word limit 20 – 30 words)

b. A corporate bond has a face value of $1 000, a coupon rate of interest of 10.5% per annum, payable semi-annually, and 20 years remaining to maturity. The market interest rate for bonds of similar risk and maturity is currently 8.5% per annum.

Required:

- What is the coupon payment of the bond?

- What is the present value of the bond?

- If the coupon payment is payable annual (based on the same information), what is the value of the bond?

Are You Searching Answer of this Question? Request Australian Writers to Write a plagiarism Free Copy for You.

Question 2:

a. Briefly discuss the relationship between the following: (Word limit 50-70 words)

- Share price and investors required rate of return

- Share price and dividend growth rate.

b. Otama LTD has an issue of preference shares outstanding that pays a $2.85 dividend every year. If this issue currently sells for $77.32 per share, what is the required return?

c. Price Tigers LTD expects to pay a $3.25 per share dividend next year. The company pledges to increase its dividend by 5.1% per year, indefinitely. If you require a return of 11% on your investment, how much will you pay for the company’s share?

Question 3:

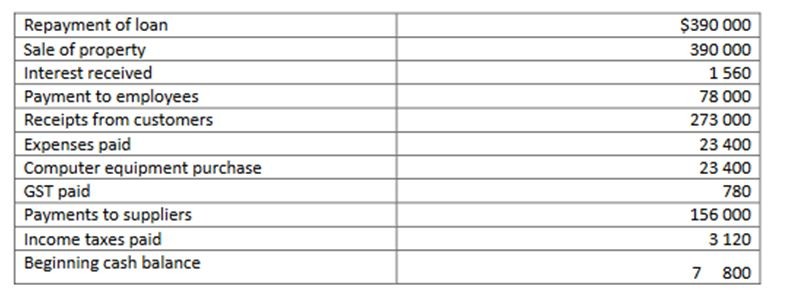

The cash flows shown below were extracted from the accounts of Jason Taylor, a music shop owner.

- Prepare a statement of cash flows using the direct method.

- Outline some cash flow warning signals.

Question 4:

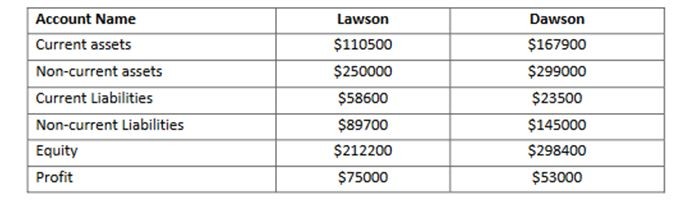

Selected information for two companies competing in the catering industry is presented in the table below:

Get Solution of this Assessment. Hire Experts to solve this assignment for you Before Deadline.

Required:

a. Calculate the following ratios for Lawson and Dawson:

- Current ratio.

- Return on Assets (ROA).

- Return on Equity (ROE).

b. From your calculations in Part (a), explain which entity is in a more favorable position.

c. Discuss two limitations of ratio analysis as a fundamental analysis tool.

Get Help By Expert

Seek help in completing your accounting assignment? Want to score high marks at Charles Sturt University (CSU) university in Australia? In order to become a master, you must take the help of expert Australian assignment writers of Australia Assignment Help who are doing Ph.D. in Accounting courses. Our writers provide fast and accurate accounting assignment help.

Recent Solved Questions

- BSBFIM601: Area That Has Mainly Contributed To Profit And Loss: Manage Finances Assessment, VU, Australia

- HI5001: Urban Consulting, a building consulting firm has just started its business The owner of the firm engaged you to prepare yearly financial statements: Accounting for Business Decisions Assignment, HI, Australia

- BSBWOR501: Assess Your Personal Knowledge And Skills Against Competency Standards: Manage Personal Work Priorities And Professional Development Assignment, VU, Australia

- Case study of Indiana a resident individual taxpayer

- SITXMGT001: Identify and describe at least two (2) immediate problems affecting efficiency and service levels evident in the scenario: Monitor work operations Report, NSW, Australia

- SITXCOM005: You Are Working As Part Of The Wait Staff At A Local Restaurant: Manage Conflict Assignment, HI, Australia

- EDUC6033 Educational Applications of Digital Technologies- Curtin University

- A20248: Provide 3 quality metrics that you will use to measure the quality of the project and any product outputs you’re expecting in your project: Project Quality Assignment, APC, Australia

- Organize A Group To Cover The 4 Topic Areas: Sustainable Hotel Environment Assignment, VU, Australia

- In Your Own Words, Define The Term Meridian: Meridian System Course Work, MU, Australia